SV Microwave Advances the RF Trend towards Smaller Communication Satellites

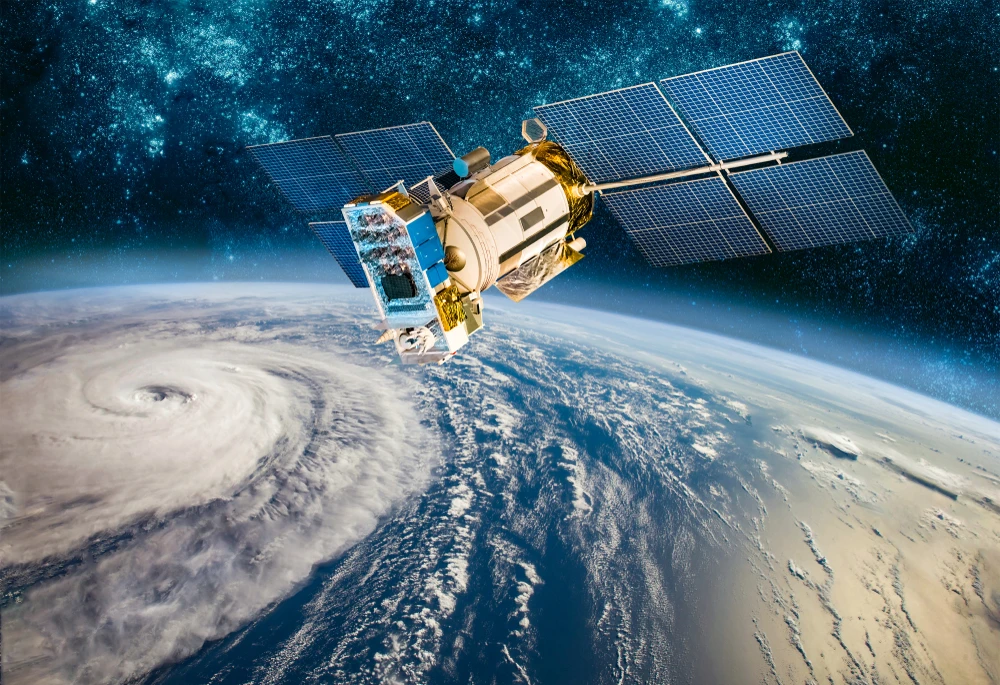

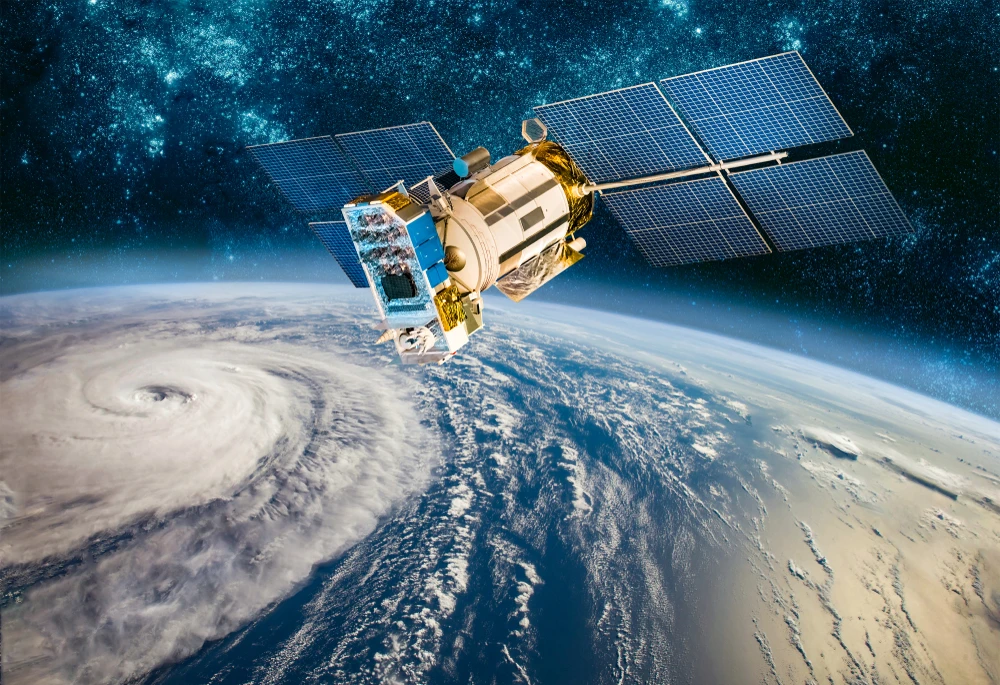

Innovative start-ups are working on small satellites that can handle the workload expected of larger satellites. ‘SmallSats’ are designed to carry powerful sensors and next-level computing capabilities in a compact frame. Their physical size can range anywhere from the size of a refrigerator, down to that of a matchbox.

The space exploration industry has defined terms according to weight classes:

1. Minisatellite: 100-180 kilograms

2. Microsatellite: 10-100 kilograms

3. Nanosatellite: 1-10 kilograms

4. Picosatellite: 0.01-1 kilograms

5. Femtosatellite: 0.001-0.01 kilograms

The primary advantage of deploying SmallSats over cumbersome conventional satellites is that launch and in-orbit costs can be substantially reduced. Launch costs for an LEO-destined small satellite launched by Rocket Lab’s Electron rocket are roughly $10,000 per pound of payload. SpaceX has more competitive pricing, charging around $1,300 per pound of payload on its medium-lift Falcon 9 rocket, and even offering a SmallSat rideshare program.

SmallSats are dominating Low Earth Orbit (LEO), where the shorter distance for radio signals to travel is an advantage for communications speed. Currently, 84% of LEO satellites are small. They make up just a mere 3% of Mid Earth Orbit (MEO) constellations, an area typically reserved for conventionally-sized satellites.

What’s driving the demand for nano and microsatellites?

The very first small satellites were launched by amateur enthusiasts in the 1960s, although technological advances and economic incentives have significantly increased their number over the past 10-15 years. Northern Sky Research has shown that the biggest driver of launch planning for nano and microsatellites came from Earth observation services. According to their report, demand for consumer-oriented and data-driven applications was behind this market pressure.

The satellite internet market has grown swiftly over the last few years. SpaceX started launching SmallSats for the Starlink internet constellation five years ago. This constellation is now made up of over 6,000 mass-produced small satellites in Low Earth Orbit.

Looking ahead to 2030, Allied Market Research has identified the demand for faster and more secure advanced communications driving the nano- and microsatellite market, alongside Earth observation. As emerging technologies continue to develop, these satellites’ ability to integrate with the Internet of Things (IoT) and Artificial Intelligence (AI) will also be important.

By expanding Earth observation capabilities, businesses and organizations can access real-time data and imagery. This enables them to make informed decisions, monitor environmental changes, and enhance operational efficiency. Since 2000, NASA has seized on these advantages of small satellites, as they can provide “rapid development and lower individual mission cost” compared to larger, more complex equipment. Over the past decade, the US Army has experimented with deploying SmallSats to deliver tactical imagery to ground forces.

A group of small satellites were deployed from 2020 to monitor mining-induced geo-hazards in a contaminated region of Indonesia. This led to a better understanding of risks from landslides, floods and Potentially Toxic Elements (PTE) contamination.

What are ‘CubeSats’, and why do they now have commercial appeal?

The term CubeSats applies to nanosatellites that fit standard dimensions. Over 2,300 have been launched since 1998. The sizing terminology centers around a certain unit, addressed by ‘U’; 1U, 2U, 3U and 12U. A ‘U’ is a cube measuring 10cm3, around the size of a Rubik’s Cube.

CubeSats are primarily used for research missions and are usually deployed in Low Earth Orbit. Many of these satellites have been deployed to give university students hands-on experience in designing, testing and operating spacecraft systems.

The versatility, modularity, and cost-effectiveness of CubeSats have been noticed by various industries. There is a short development cycle for a simple CubeSat made with off-the-shelf components, which can last just a few months using a small team.

There are commercial applications for launching these nanosatellites, particularly in fields such as agriculture, archaeology, civil engineering, energy, forestry, media and traffic monitoring. Satellite Markets & Research has forecast the global CubeSat market size to be $491m by 2027.

The advantages of our RF components for designing small satellites

Key engineering decisions are being made based on the size, weight and power (SWaP) constraints of RF/microwave components used in building mini, micro and nanosatellites.

With a tiny form factor, such off-the-shelf components are attractive for small satellites due to these advantages:

1. Overcoming payload limitations

2. Reducing power consumption

3. Easier and more flexible integration

4. Attractive for custom development

5. Lower costs

Major names in the space industry are keen to take advantage of SV Microwave’s specialism in lightweight space-qualified RF components. Our Hi-Rel connectors and cables have been used in commercial payloads for companies such as Direct TV, SiriusXM and EchoStar. They have also been deployed in military communication satellites launched by DRL, Milstar, MUOS and others.

Our line of UltraLite RF cable connectors is carefully designed using aluminum. These are 66% lighter than those made using stainless steel, yet deliver the same RF performance. This is particularly attractive for a GPS satellite build, which may need to contain thousands of RF connections.

We also offer high-density RF cable assemblies for deploying within embedded system applications. These have a highly flexible cable with minimal solder movement, allowing for tight spaces behind the connector, which makes them ideal for intricate wiring configurations.

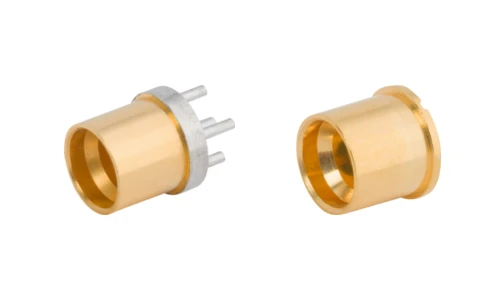

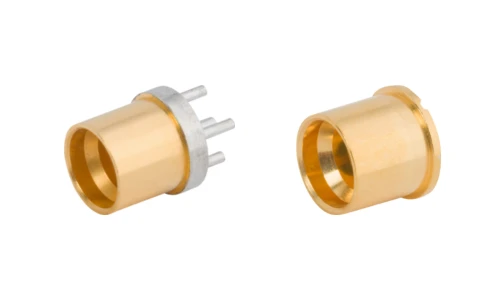

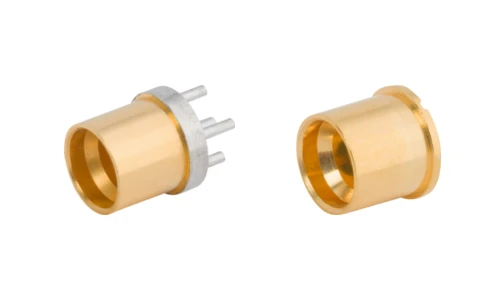

Another line we’ve aimed at builders of small satellites is our SMPM PCB connectors. These high-quality components have a 33% smaller footprint compared to their Subminiature Push-on (SMP) counterparts.

We produce connectors that meet the M39012 standard set by the US Department of Defense. These meet the high durability and performance specifications for use in military and aerospace applications.

As the trend for small satellites and off-the-shelf connectors continues, SV Microwave is committed to developing innovative, lightweight space-qualified RF components that meet the challenging constraints of the small form factor.

recent releases

SV Microwave Advances the RF Trend towards Smaller Communication Satellites

Innovative start-ups are working on small satellites that can handle the workload expected of larger satellites. ‘SmallSats’ are designed to carry powerful sensors and next-level computing capabilities in a compact frame. Their physical size can range anywhere from the size of a refrigerator, down to that of a matchbox.

The space exploration industry has defined terms according to weight classes:

1. Minisatellite: 100-180 kilograms

2. Microsatellite: 10-100 kilograms

3. Nanosatellite: 1-10 kilograms

4. Picosatellite: 0.01-1 kilograms

5. Femtosatellite: 0.001-0.01 kilograms

The primary advantage of deploying SmallSats over cumbersome conventional satellites is that launch and in-orbit costs can be substantially reduced. Launch costs for an LEO-destined small satellite launched by Rocket Lab’s Electron rocket are roughly $10,000 per pound of payload. SpaceX has more competitive pricing, charging around $1,300 per pound of payload on its medium-lift Falcon 9 rocket, and even offering a SmallSat rideshare program.

SmallSats are dominating Low Earth Orbit (LEO), where the shorter distance for radio signals to travel is an advantage for communications speed. Currently, 84% of LEO satellites are small. They make up just a mere 3% of Mid Earth Orbit (MEO) constellations, an area typically reserved for conventionally-sized satellites.

What’s driving the demand for nano and microsatellites?

The very first small satellites were launched by amateur enthusiasts in the 1960s, although technological advances and economic incentives have significantly increased their number over the past 10-15 years. Northern Sky Research has shown that the biggest driver of launch planning for nano and microsatellites came from Earth observation services. According to their report, demand for consumer-oriented and data-driven applications was behind this market pressure.

The satellite internet market has grown swiftly over the last few years. SpaceX started launching SmallSats for the Starlink internet constellation five years ago. This constellation is now made up of over 6,000 mass-produced small satellites in Low Earth Orbit.

Looking ahead to 2030, Allied Market Research has identified the demand for faster and more secure advanced communications driving the nano- and microsatellite market, alongside Earth observation. As emerging technologies continue to develop, these satellites’ ability to integrate with the Internet of Things (IoT) and Artificial Intelligence (AI) will also be important.

By expanding Earth observation capabilities, businesses and organizations can access real-time data and imagery. This enables them to make informed decisions, monitor environmental changes, and enhance operational efficiency. Since 2000, NASA has seized on these advantages of small satellites, as they can provide “rapid development and lower individual mission cost” compared to larger, more complex equipment. Over the past decade, the US Army has experimented with deploying SmallSats to deliver tactical imagery to ground forces.

A group of small satellites were deployed from 2020 to monitor mining-induced geo-hazards in a contaminated region of Indonesia. This led to a better understanding of risks from landslides, floods and Potentially Toxic Elements (PTE) contamination.

What are ‘CubeSats’, and why do they now have commercial appeal?

The term CubeSats applies to nanosatellites that fit standard dimensions. Over 2,300 have been launched since 1998. The sizing terminology centers around a certain unit, addressed by ‘U’; 1U, 2U, 3U and 12U. A ‘U’ is a cube measuring 10cm3, around the size of a Rubik’s Cube.

CubeSats are primarily used for research missions and are usually deployed in Low Earth Orbit. Many of these satellites have been deployed to give university students hands-on experience in designing, testing and operating spacecraft systems.

The versatility, modularity, and cost-effectiveness of CubeSats have been noticed by various industries. There is a short development cycle for a simple CubeSat made with off-the-shelf components, which can last just a few months using a small team.

There are commercial applications for launching these nanosatellites, particularly in fields such as agriculture, archaeology, civil engineering, energy, forestry, media and traffic monitoring. Satellite Markets & Research has forecast the global CubeSat market size to be $491m by 2027.

The advantages of our RF components for designing small satellites

Key engineering decisions are being made based on the size, weight and power (SWaP) constraints of RF/microwave components used in building mini, micro and nanosatellites.

With a tiny form factor, such off-the-shelf components are attractive for small satellites due to these advantages:

1. Overcoming payload limitations

2. Reducing power consumption

3. Easier and more flexible integration

4. Attractive for custom development

5. Lower costs

Major names in the space industry are keen to take advantage of SV Microwave’s specialism in lightweight space-qualified RF components. Our Hi-Rel connectors and cables have been used in commercial payloads for companies such as Direct TV, SiriusXM and EchoStar. They have also been deployed in military communication satellites launched by DRL, Milstar, MUOS and others.

Our line of UltraLite RF cable connectors is carefully designed using aluminum. These are 66% lighter than those made using stainless steel, yet deliver the same RF performance. This is particularly attractive for a GPS satellite build, which may need to contain thousands of RF connections.

We also offer high-density RF cable assemblies for deploying within embedded system applications. These have a highly flexible cable with minimal solder movement, allowing for tight spaces behind the connector, which makes them ideal for intricate wiring configurations.

Another line we’ve aimed at builders of small satellites is our SMPM PCB connectors. These high-quality components have a 33% smaller footprint compared to their Subminiature Push-on (SMP) counterparts.

We produce connectors that meet the M39012 standard set by the US Department of Defense. These meet the high durability and performance specifications for use in military and aerospace applications.

As the trend for small satellites and off-the-shelf connectors continues, SV Microwave is committed to developing innovative, lightweight space-qualified RF components that meet the challenging constraints of the small form factor.